Advertisement

In the past few years, M&A activities in the games industry have been overdriven, often reaching billions of dollars in scale. Many issuers have also begun to invest heavily in market segments or establish cooperative relationships with other companies.

Zynga, for example, bought Peak Games, publisher of mobile game in Turkey, for $1.8 billion. Bought a majority stake in Finland's Small Giant Games for another $560m. It also acquired Rollic Games and Gram Games, makers of ultra-casual mobile game, for $250 million and $168 million, respectively.

Zynga, for example, bought Peak Games, publisher of mobile game in Turkey, for $1.8 billion. Bought a majority stake in Finland's Small Giant Games for another $560m. It also acquired Rollic Games and Gram Games, makers of ultra-casual mobile game, for $250 million and $168 million, respectively.

At the same time, mobile interactive entertainment company Scopely also completed the acquisitions of Disney's game studio FoxNext Games and Irish Digit Game Studios. Activision Blizzard cooperated with Tencent, jointly developed FPS mobile game Call of Duty: Mobile. Just one year after it went live, the total global revenue of Call of Duty in the App Store and Google Play has reached $480 million.

In this article, Sensor Tower will analyze the aforementioned transactions and other acquisitions to further understand the specific impact of these acquisitions on the mobile game market.

Sensor Tower will analyze the revenue and downloads of the top game categories in the U.S. market in the first 1-3 quarters of 2020 to understand the market share of major publishers. These data can not only show the performance of certain manufacturers in a specific sub-category market, but also show the impact of acquisition transactions on the market structure.

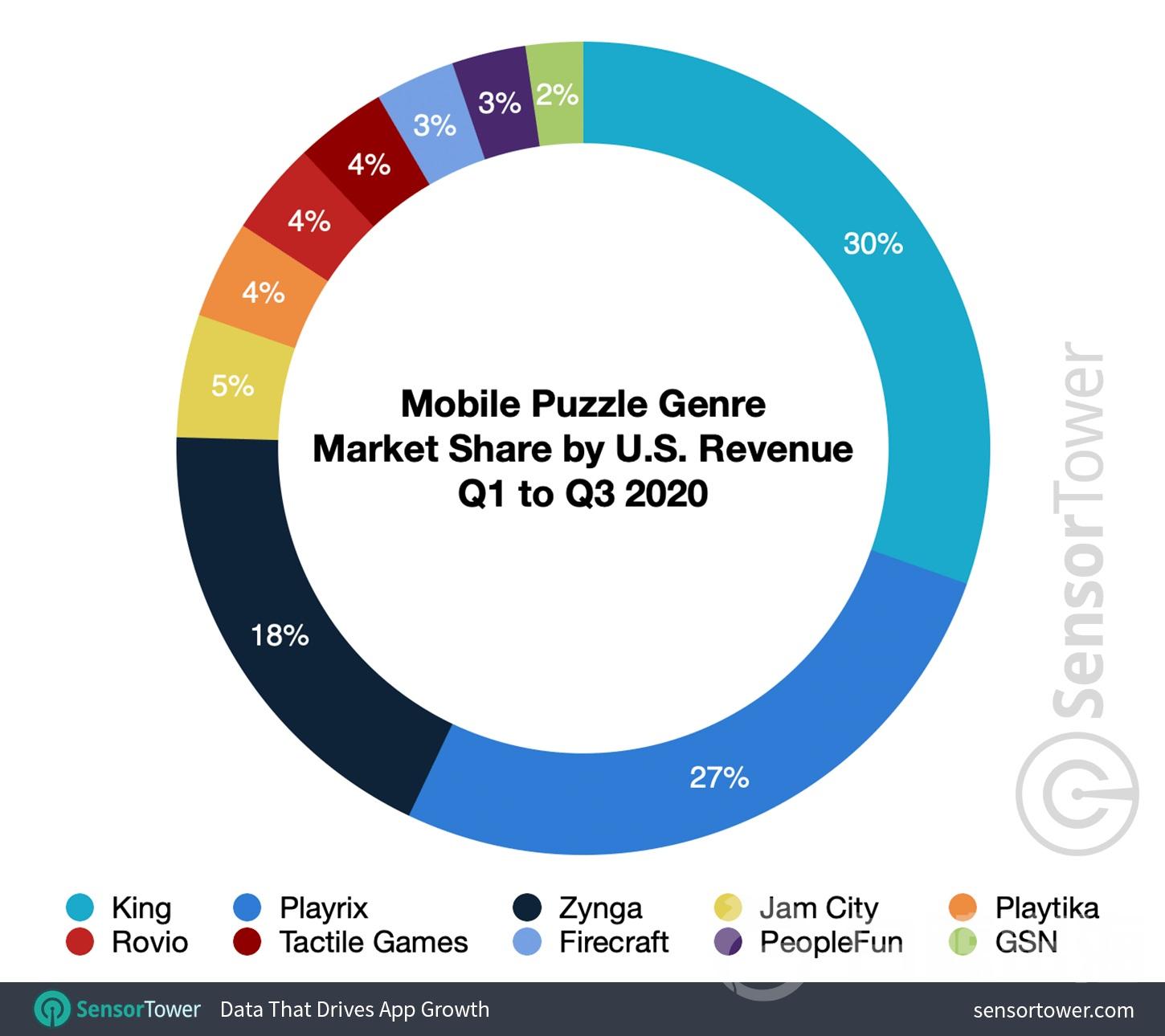

Puzzle Games

During the first 9 months of 2020, the British publisher--King became the leader in the American puzzle game market. Prior to this, Activision Blizzard spent $5.9 billion at the end of 2015 to complete the acquisition of King. Driven by the head product of Candy Crush Saga , King's total user spending increased by 6% year-on-year to approximately $ 846 million.

Casual game publisher Playrix ranks second in market share. The company's Gardenscapes, Homescapes and Fishdom and other works have maintained strong growth. Thanks to this, Playrix's puzzle game revenue has nearly doubled year on year, reaching nearly $742 million.

Advertisement

Zynga, by contrast, has grown its share mainly through acquisitions. Zynga recently acquired Peak Games, the publisher of the match-3 mobile game Toon Blast, for $1.8 billion. Gram Games, the Turkish maker of Merge Dragons, was also acquired in 2018 for $250 million.

Zynga, by contrast, has grown its share mainly through acquisitions. Zynga recently acquired Peak Games, the publisher of the match-3 mobile game Toon Blast, for $1.8 billion. Gram Games, the Turkish maker of Merge Dragons, was also acquired in 2018 for $250 million.

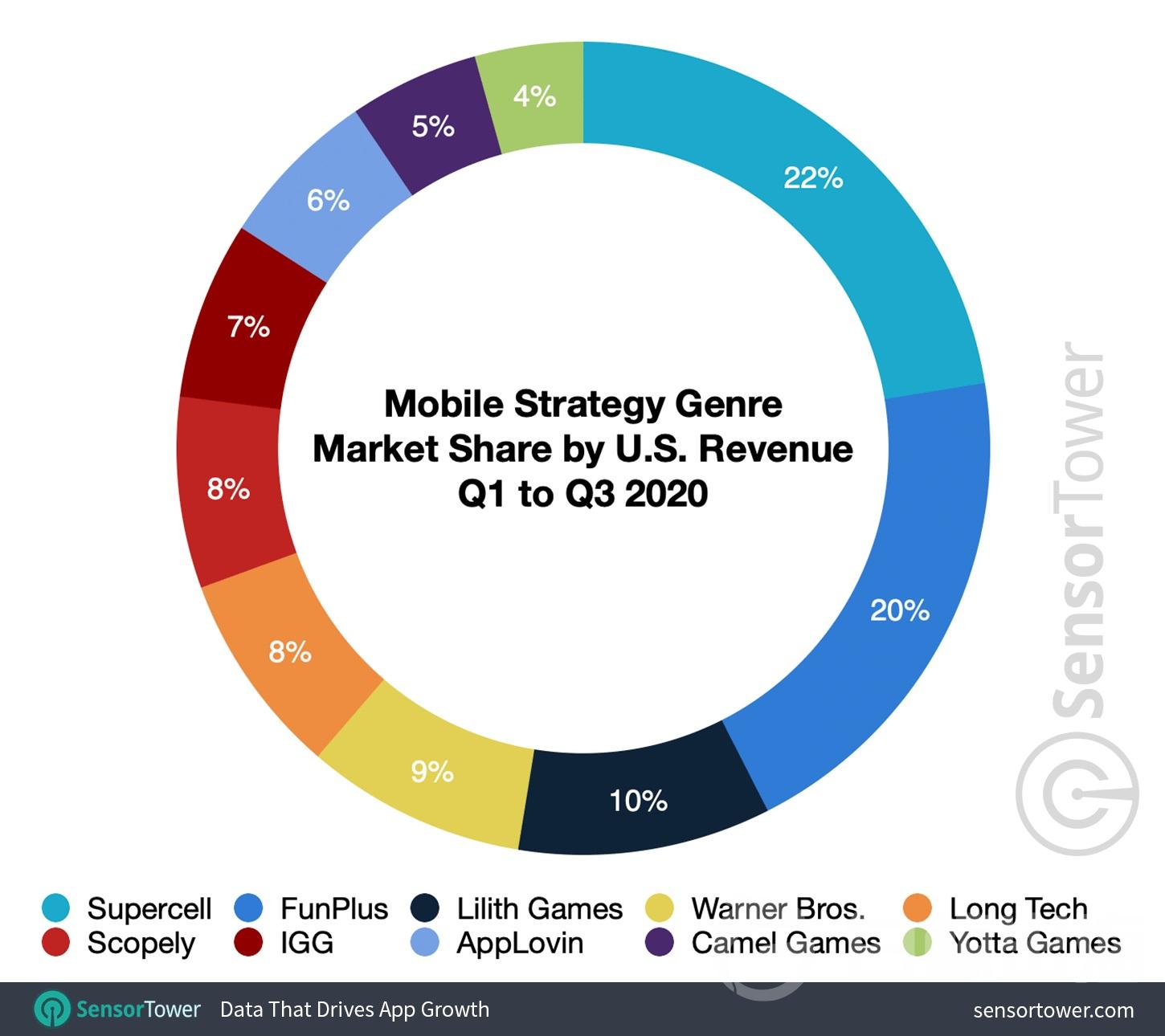

Strategy Games

In the strategy game market, Supercell, the publisher of "Clash of Clans" and "Clash Royale" (Clash Royale) ranked first in revenue. In the first nine months of 2020, the company's total revenue in the U.S. market is approximately $378 million.

FunPlus ranked second. The company released works such as King of Avalon and Guns of Glory, and its overall revenue increased by 58.7% year-on-year to nearly $339 million.

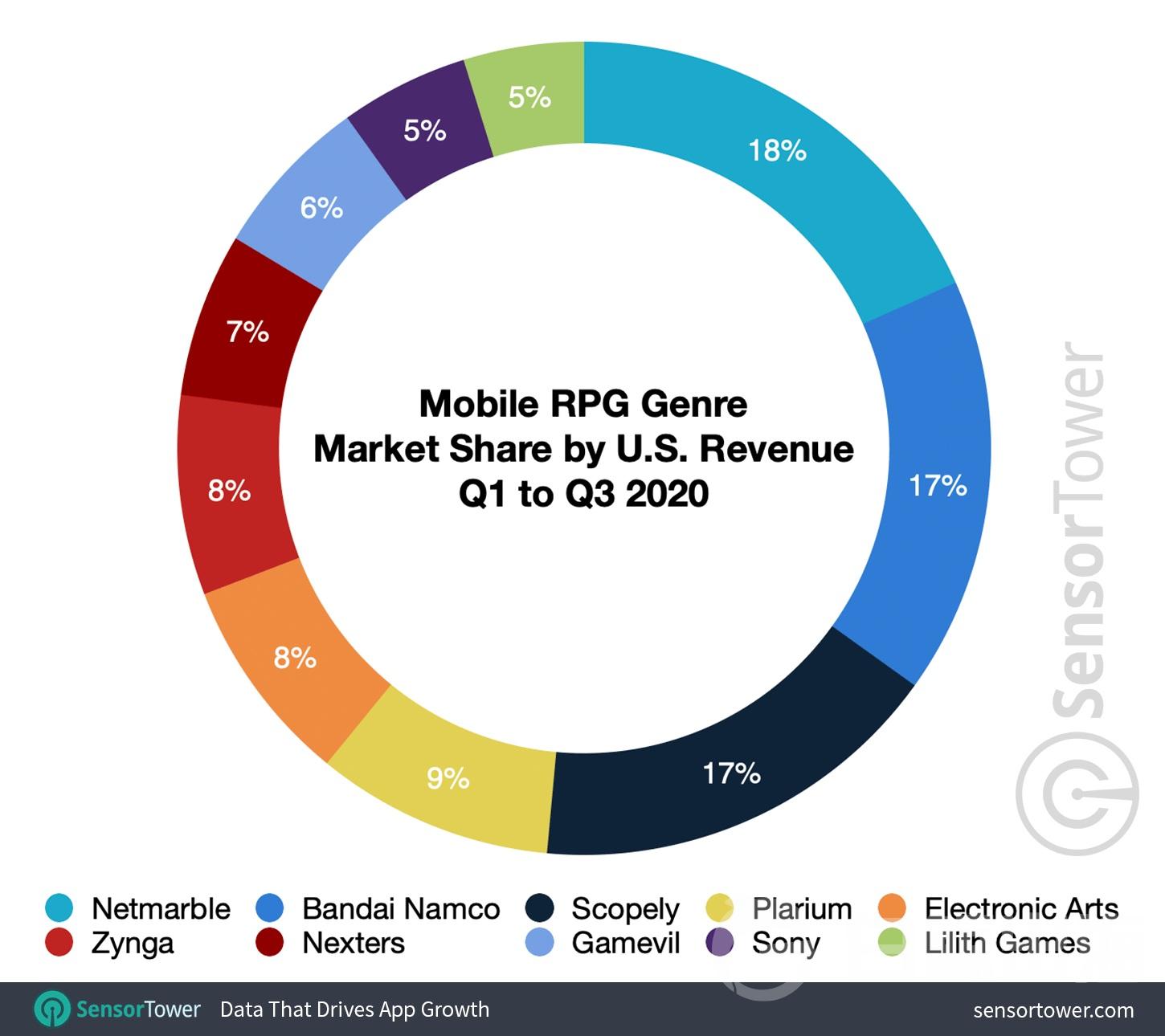

RPG Games

In the first 1-3 quarters of 2020, South Korean game company Netmarble is the company with the highest revenue in the US RPG mobile game market. Netmarble acquired game manufacturer Kabam in 2017. With the large-scale RPG fighting mobile game Marvel Contest of Champions developed by Kabam, Netmarble's total revenue has also increased significantly, with total user spending exceeding $254 million. An increase of 68.6% year-on-year.

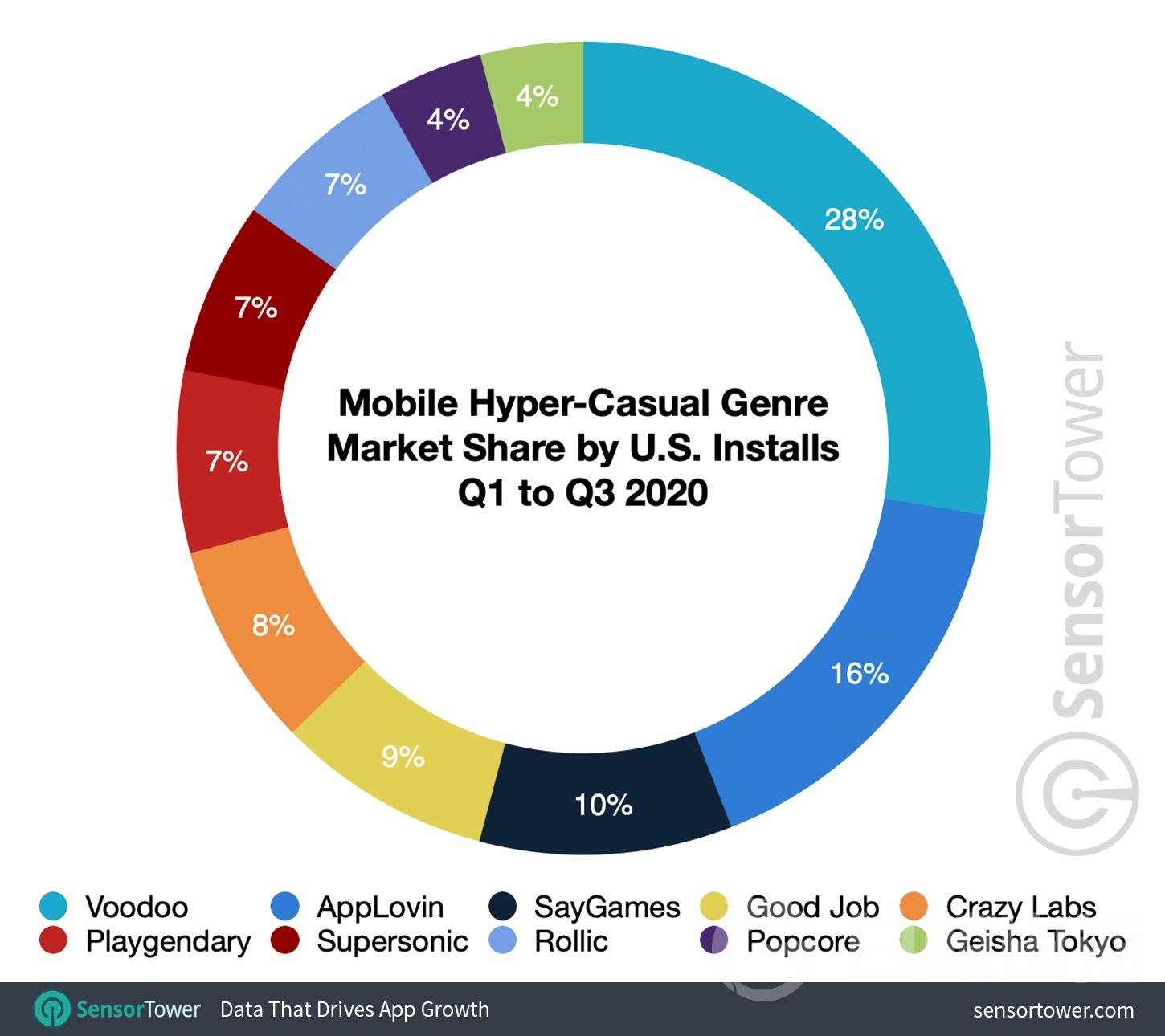

Ultracasual Games

During the 1-3 quarters of 2020, Voodoo invested by Tencent is the most downloaded hyper-casual game publisher in the US market, with 210 million downloads in the same period. At the same time, AppLovin relied on its studio Lion Studios to officially enter the ultra-casual game market, with a cumulative download of approximately 125 million times during the same period.  The ultra-casual game market is extremely competitive, and many companies are moving into the category or building their strength through strategic investments and acquisitions. Like AppLovin, the mobile monetization platform ironSource also announced the establishment of a casual game team Supersonic Studios in early 2020, officially entering the field of ultra-casual games.

The ultra-casual game market is extremely competitive, and many companies are moving into the category or building their strength through strategic investments and acquisitions. Like AppLovin, the mobile monetization platform ironSource also announced the establishment of a casual game team Supersonic Studios in early 2020, officially entering the field of ultra-casual games.