Advertisement

When you can spend your time doing work you love without worrying about your daily expenses, your financial freedom is achieved.

One of the best aspects about the definition of financial freedom is that it does not require you to accumulate a lot of fortune. It just needs you to find a way to pay for all your living expenses while doing a job you really enjoy and saving a little bit of extra income for retirement.

According to this definition, an artist making $38,000 a year has more financial freedom than an investment banker earning $380,000.

10% rule

The time it takes to achieve financial freedom comes down to one factor. The amount of money you can earn from doing what you love is related to the cost of living.

If you have a 9 to 5 job that you do not like, the only way to achieve financial freedom is to find a job you absolutely love. This does not mean you should resign. After all, your income provides financial security for you and your family.

Instead of leaving your job, why not find a sideline business which you enjoy and set a target of getting 10 percent of your current income from that sideline job over the next 12 months.

In your second year on the sideline business, your target is to earn 20 percent of your daily income.

You are on board to achieve financial freedom if you keep improving in this way.

It makes me to think about the 10 percent rule: If you can earn 10 percent of your current income in the first year by doing work you love, and the percentage is growing by 10 percent, you will achieve financial freedom in no more than 10 years.

According to the 10 percent rule, how do you know exactly when you can achieve the financial freedom.

The simplest way to understand how the 10% rule works is to refer to an example.

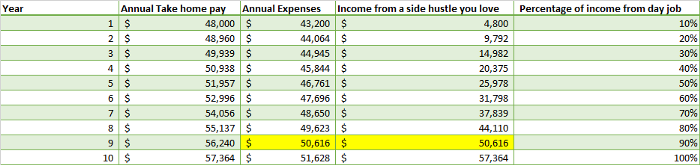

Let us make the following assumptions.

You have a formal job that pays you $70,000 a year.

After tax, your annual income is $48,000.

Your annual expenses are equivalent to 90% of your after-tax income, which is $43,200.

Every year, your net payment and expenses rise to 2 percent.

Maybe you like cooking and preparing delicious food in the kitchen is one of your favorite things. So, you found a sideline business and spent your spare time making recipe videos.

In the first year of your cooking sideline business, your target is to replace 10 percent of your after-tax income, which $4,800.

In the second year of your sideline business, your target is to replace 20 percent of your after-tax income with a sideline business income, which comes to $9,792.

Every year, you increase your sideline income to replace the 10 percent extra after-tax income from your daily job.

After year 9, your income from the sideline and your annual expenses are up to $50,616.

When you can pay for living expenses on a job you love, you have achieved financial freedom.

To make it clear, in order to make sure you're making the same comparison, the income you earn from your side business should also be taxed, since it replaces the net income you earn from your daily job.

Living frugally will greatly reduce your time to achieve financial freedom

If nine years sounds like too long, there is another way from which you don't have to wait for nine years.

Advertisement

Keep in mind, the key to financial freedom is that you can pay all your living expenses with income from a job you love.

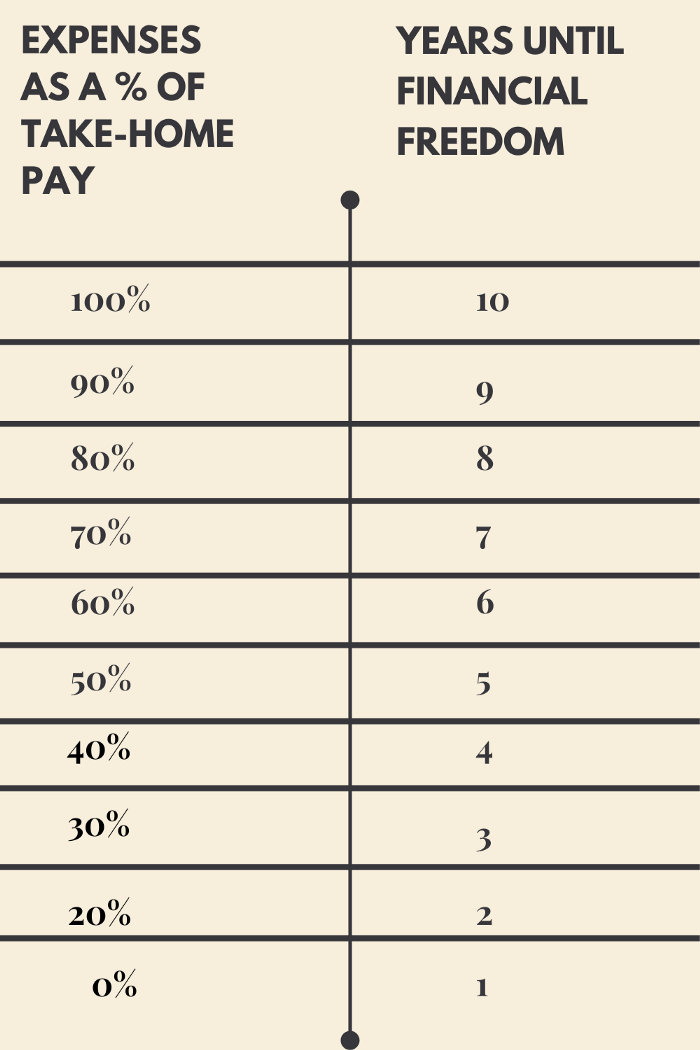

In the above example, it took us nine years to become financially free, and we assumed that in the first year, your living expenses were 90 percent of your after-tax income.

The lower your living expenses as a percentage of your net income is, the less of your current income you will need to replace from a sideline business.

If your living expenses are 80 percent of your after-tax income, you can achieve financial freedom in eight years.

If your living expenses are 70 percent of your after-tax income, you can achieve financial freedom in seven years.

Assuming you can replace 10 percent of your after-tax income with a sideline business, the lower your living expenses are, the faster you can achieve financial freedom.

The faster you adjust your income, the faster you will achieve financial freedom

The “10 percent rule” assumes that you replace 10 percent of your daily work income each year with your interested sideline business or project. I chose 10 percent for two reasons.

1. This number is relatively realistic (pursuing what you love can take a long time to pay off).

2. 10 percent is an integer, and people like integers.

My point of view is, 10 percent is not a magic number, it is something roughly. If you can replace more than 10 percent of your daily income each year with something you enjoy, you'll be able to achieve financial freedom more quickly.

The only magic number is the difference between your annual expenses and your net income from the job you love, and once that number is $0, you are financially free.

What is “living cost”?

I have been using the word living cost, so what does living cost include? It is as simple as taking money out of your pocket or bank account.

This means all your traditional living expenses such as housing, food, transportation, entertainment, travel, etc.

Seasonal purchases such as birthdays and holidays.

It also includes some short-term savings, such as emergency money, a home repair cost or travel cost.

Finally, it includes the basic amount you need to save and invest for a long-term retirement plan.

Yes, you need to save for retirement, and if you are doing a job you love, you might think, “I’ll never need to retire.” But the thing is, whatever you say may not count.

When you reach the traditional retirement age, your health or finances may not allow you to keep on working.

So, before you can achieve financial freedom, you need to save a fundamental amount for retirement from your sideline income.

There are two ways to do this.

Simply saving 10 percent of your income for retirement is not a smart way for budget.

Take some time to figure out how much you need to save for retirement according to your situation. It takes a lot of work, but it's worth it.

Once you can pay for all your living expenses and savings needs by doing what you love, you will achieve financial freedom.

Financial freedom is not a lifetime guarantee

Because financial freedom depends on how much income you can earn from doing what you love, it is an unstable status. Financial freedom does not guarantee lifetime freedom.

If you do not earn enough income from the job you love to cover your expenses, you may also lose your financial freedom.

If you just have a bad income in a few months, that may be a temporary situation, but if it is a permanent situation, you need to take on a part-time or other full-time job which is from 9am to 5pm. You may not love it, but after all, you need to move on to pay the living expenses.

That is why many people do not really think they're financially free when their sideline income starts to exceed their living expenses.